"I Care A Lot” reveals the unfortunate reality of POA and Health Care Proxy

In 2021, Netflix released the movie “I Care A Lot.” In this film, a rich Marla Grayson repeatedly convinces the court that elderly individuals are not mentally stable and need to be taken care of. After the court grants her guardianship, she moves her victims into an assisted living facility, sedates them, and takes their phones to ensure zero contact with the outside world. During this period, Marla sells her client’s properties, cars, and assets and banks the profit. However to her surprise, her next victim Jennifer Peterson is a lot harder to manage. Peterson’s son is a dangerous mafia boss who makes it his mission to make Marla’s life miserable and release Jennifer from the assisted living facility. While the film is intended to be a satirical and dark comedy, it references many financial and healthcare issues that could have been prevented with a definitive estate plan that included a Power of Attorney and Healthcare Proxy.

“I Care A Lot” Teaches Valuable Estate Planning Lessons

One day, Marla knocks on Jennifer's door and randomly presents herself as a newly appointed guardian. This could have been prevented if Jennifer, an extremely wealthy elderly woman, had appointed a power of attorney and healthcare proxy. While many often believe the two tackle the same problems, that is incorrect. A power of attorney appoints someone to take care of financial decisions for you. On the other hand, a healthcare proxy appoints someone to make medical decisions for you when you are no longer mentally or physically capable to do so.

Real-World Implications

Although the film is clearly intended to be satirical and dramatizes the life of a fraudster, elder financial exploitation is no laughing matter and has been on the rise. According to a 2018 article from the Securities and Exchange Commision, a study in New York state found that financial fraud cost elderly victims $109 million, though that number is likely much higher due to underreporting and the higher occurrence of healthcare fraud since the beginning of the COVID-19 pandemic. An article from the American Bankers Association reports that financial crimes cost elderly victims $2.9 billion in 2022. Elder financial abuse is among the most frequent forms of elder abuse, and elderly people are more likely on average to be targeted for financial fraud. Two factors in the prevalence of elderly financial exploitation are social isolation and mental impairment. Those older persons without close family or friends and those with physical or mental impairments such as Alzhemeir’s are more likely to be victims of financial crimes and are the preferred targets of fraudsters.

Elder financial exploitation takes many forms. In some cases, it may involve a caregiver convincing the victim to sign over to them their power of attorney. In other cases, it might involve a caregiver stealing a victim’s cash, cashing their social security checks, or using their credit cards. In more extreme cases, it might involve the victim signing over inheritance rights to real estate or savings accounts to “new best friends” or previously uninvolved relatives. Because there are no physical signs of abuse, elder financial exploitation can be extremely difficult to catch and can continue for years before irregularities are finally realized.

How To Protect Your Loved Ones

To protect your loved ones from potential exploitation, it is important to look for warning signs and report them immediately. It is also important to familiarize yourself with the wide-range of warning signs and the organizations dedicated to investigating and preventing elder financial exploitation. Some warning signs include fraudulent signatures on financial documents, unpaid bills that had previously been recurring automatic charges, sudden changes in a person’s will, trusts, or insurance coverage, and an unexplained transfer of assets to a caregiver or unknown third-party. This list is not exclusive, as fraud can occur through investments and annuities, telephone “sweepstakes” scam, and phony home-repair charges.

Some of the many helpful organizations at your disposal include the Adult Protective Service, National Elder Fraud hotline, and Long-Term Care Ombudsman programs. An experienced elder planning and Medicaid fraud attorney will also help in perceiving cases of fraud and contacting the proper authorities. In addition to these resources, it is important to be open and honest when discussing finances with your loved ones. Never sign a financial document without a second opinion, and never feel pressured to engage in a business dealing or investment. Report anything you feel uncomfortable about to your loved ones or the proper authorities. Above all, do not remain silent!

Conclusion

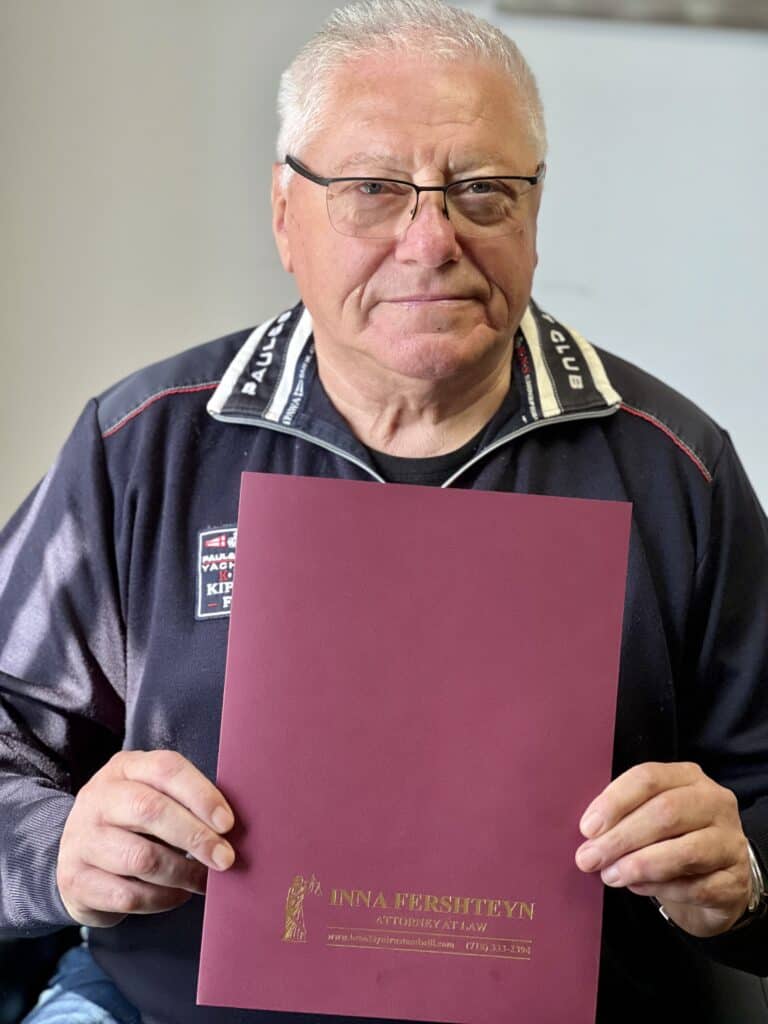

The satirical “I Care A Lot” is a worthy watch and certainly has its humorous moments, however it is most important to heed its lessons. Elderly people are at particular risk for financial crimes, and they are often the preferred target for fraudsters because of their perceived vulnerability and fragile health. Although the signs of exploitation and fraud are varied and sometimes hard to spot, remaining vigilant and engaging in frank financial discussions with your loved ones will help protect you from becoming a victim. Having an experienced estate planning and asset protection lawyer in your corner will also help you to prevent any potential damaging financial occurrences. For all your asset protection needs, call the Trust and Estate Planning Law Office at (718) 333-2395.