New York City Asset Protection Attorney–Protect Your Assets Now

In New York, over 10,000 lawsuits are filed every year. What’s at stake? The hard earned assets your family owns. America is a highly litigious society, and as a result, people can be hit with a lawsuit or divorce seemingly out of nowhere. When that happens, you’ll want to have asset protection strategies already in place! Understanding legally how to protect your assets is one of the most important things you’ll ever learn. The fact is, by hiring an asset protection attorney in New York now, when creditors, third parties, litigious entities, and financial aggressors come after everything you own or when faced with a legal battle, you’ll already be in a superior position.

Don’t wait until it’s too late. Plan and protect what you’ve spent a lifetime building right now. Call (718) 333-2395.

Based in New York City, The Law Office of Inna Fershteyn can help you. Through asset protection planning for Clients throughout New York City and beyond, we make sure you are:

- Protecting your accumulated wealth and assets proactively

- Protecting your money from creditors legally

- Protecting your money from impending or future lawsuits

It’s important to note that we will help you protect your assets, not hide them.

To protect your assets, there are legal strategies to properly protect yourself. Both estate planning and tax planning are essential to protecting your assets within the law.

An experienced attorney will review your assets and help you develop an estate plan that will reduce the risk of your assets being taken by third parties in a litigation scenario.

Another legal option is working on your tax planning. Every legal path varies when it comes to tax planning so it is important to know how your assets will be taxed before creating your plan. Our New York City asset protection lawyer will work with you to analyze your financial situation and develop a plan to ensure that your money is well spent. The Law Office of Inna Fershteyn can help you protect your assets.

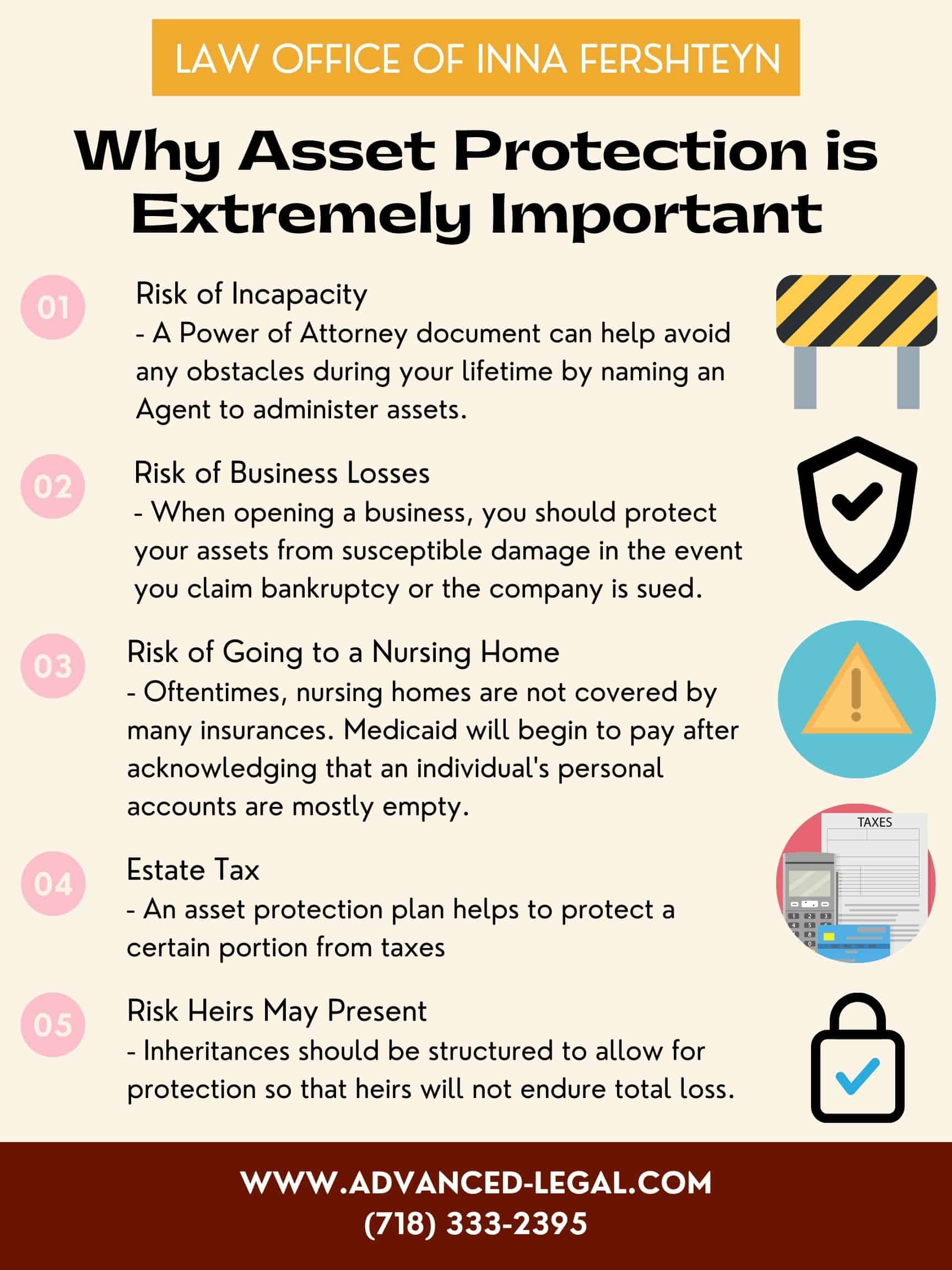

What is Asset Protection Planning?

Asset protection planning is a proactive legal process that safeguards your wealth from creditors, divorce, lawsuits, or judgments. This action will ensure a smooth transition of your assets to your heirs with minimal taxes and without court proceedings. Asset protection strategies involve a series of legal and lawful techniques that can deter or minimize an unfavorable outcome from a lawsuit. It can also give you settlement negotiation power, but most importantly it can help prevent the seizure of your assets in the event of an unfavorable judgment. Examples of legal paths include establishing asset protection trusts, establishing LLCs, and equity-stripping strategies.

How We Benefit Our Clients with Asset Protection

We benefit our clients with asset protection because we ensure that our clients and their trusted loved ones have control over their hard-earned assets, protect assets from creditors, and even help clients obtain Medicaid through asset protection.

NY asset protection attorney Inna Fershteyn Esq. has been in business for 22 years. She works with the Medicaid office very closely handling Medicaid fraud cases and helping her clients obtain Medicaid. One of the ways she helps her clients obtain Medicaid is by helping them set up asset protection trusts or irrevocable trusts. These trusts help clients transfer properties into asset protection entities.

The Types of Assets Our Law Firm Reviews

The types of assets our firm reviews include a wide variety. We review assets such as bank accounts, real estate, tangible property, investment accounts, LLCs, stocks and bonds, and life insurance.

Bank accounts–also known as cash accounts such as checking, savings, money market, and CDs. However, you should check with your financial institution before you try to transfer an account or saving certificate.

Real estate–this includes personal residences and investment properties. Transferring real estate into a trust means you will have to transfer the legal title to your trustee. You will have to execute, notarize, and record a new deed in the name of your trust.

- Mortgage-if there is a mortgage on any of your properties, it is advisable to contact the mortgage company before initiating the transfer.

- Title insurance & homeowner’s insurance-when putting your home in a trust, one of the things that you must do first is add the trust to your house insurance policy and any other applicable umbrella policies.

Tangible property–Any physical object you own can be considered. For example, motor vehicles, boats, airplanes, firearms, pets, horses, and tools. Personal effects can be considered too such as jewelry, clothing, books, furniture, antiques, paintings, etc.

Investment accounts–Similar to bank accounts, you can transfer your investment accounts into a trust. It is advisable to check if you named beneficiaries in your investment accounts and if those beneficiaries match your trust.

LLCs–If you are going to transfer any limited liability companies, you have to register any partnerships in the name of the trustee because they require the consent of some or all partners.

Stocks and bonds–Any stocks issued in certificate form must be registered in the trustee’s name and you need to issue a new certificate. Any bonds must also be registered in the name of the trustee and a new bond will need to be issued.

Life insurance–You can change the ownership of your life insurance policy to your trust. It will give your successor trustee legal authority over the policy. If you ever become mentally incapacitated, they can borrow against its cash value to pay for your care.

Why Your Assets Are Susceptible and Vulnerable

If you don’t properly protect your assets, they may be susceptible and vulnerable to creditors or can be lost quickly in the midst of a lawsuit or bankruptcy. In order to make sure your assets aren’t vulnerable to these circumstances, you should meet with an experienced estate planning lawyer who can give you strategies and approaches to protect yourself from creditors, who may have claims against your assets in the future. Many times, the biggest creditor that could go after your assets is a former spouse. In the event of a divorce, an asset protection attorney will make sure to prevent this from happening.

Top 10 Asset Protection Planning Strategies You Can Use To Protect Yourself from Creditors or a Lawsuit in New York

There are many different ways of protecting your assets from creditors or lawsuits. Some of the most common strategies are:

- Asset Protection Trusts

- Revocable and Irrevocable Trusts

- Living Wills

- Special Needs Trusts

- Medicaid Planning

- Elder Law Planning

- Corporate Structures

- Retirement Accounts

- Guardianships

- Generation-Skipping Trust

Why Now Is The Time to Consult An Attorney

Rather than waiting for potential lawsuits and other situations to arise, it is crucial to protect your assets now rather than later. Consulting with an experienced attorney specializing in asset protection is necessary to create a plan that’s right for you. With laws constantly changing, it’s important not to rely on online resources to protect your assets. Speak with a local attorney who is up to date on recent New York laws can create an asset protection plan that is unique to your own circumstances.

Asset Protection Service Areas

Our asset protection attorney is based in Brooklyn, NY representing clients throughout the New York City 5 Boroughs, Long Island (Nassau County and Suffolk county), the NY Metro area and other States. To find out how the Law Office of Inna Fershteyn can help you, give us a call at (718) 333-2395.

Asset Protection Case Studies

- In October 2020, an elderly client residing in Brooklyn, NY was looking at ways to start Long-Term Care Planning without losing her assets. Attorney Inna Fershteyn advised her client that there are numerous ways to go about protecting their assets, while still being able to pay for a nursing home if it ever came to it. The attorney advised her client to create an Irrevocable Trust, which would protect their assets from nursing home bills in the case that such a transfer was made five or more years from the time one gets put in a nursing home.

- In March 2021, a client came in with the intention of creating a special needs trust for her disabled daughter. The attorney created a clause in the family trust that transfers a portion of the assets into a separate special needs trust for the daughter. Within one week, a consultation was scheduled and a draft of the trust was created.

- In June 2021, a client wanted to transfer five of his properties into an asset protection trust. A consultation was scheduled and a trust was drafted within one week. The client also had special requests that the attorney tended to. All included properties were transferred and official deeds were successfully created within three weeks.

Asset Protection FAQs

1.) Is it legal to hide assets?

Yes, hiding assets can be done legally. To do so, please contact a lawyer for legal advice and do so as soon as possible.

2.) What is the legal way to hide assets from creditors?

- Retirement accounts (limited protection, early withdrawal from account = 10% of account not accessible)

- Asset protection trust

- Irrevocable trust

- A revocable trust

- Special needs trust

- Pooled-income trust

3.) When should I consider asset protection?

The ideal time to preserve your assets is well before a creditor threat is looming. This implies you should take the following precautions to safeguard your assets:

- At least two years before declaring bankruptcy.

- Before your marriage ends in divorce, (If you want to undertake particular pre-marital/pre-divorce planning and a prenuptial agreement isn't an option, it's preferable to start your program before you are married.)

- Before you are threatened with a lawsuit.

- Before your company goes bankrupt.

In general, it is too late to conduct asset protection once you have a judgment against you unless you have an agreement to pay off the judgment (and follow through on that agreement) and are just aiming to preserve assets from future creditors.

4.) How secure will my assets be in a Trust?

It depends on the Trust you set up with an attorney:

Revocable Trust- A revocable trust allows the person who created the trust to change or terminate the trust at any time during their lifetime. Most trusts are revocable. A revocable trust can help you avoid probate which is a lengthy process that your loved ones will have to go through after your death. It’s important to note that assets in a revocable trust will be considered personal assets for estate tax purposes. For creditors, this means they can potentially have access to your assets if you have debt when you pass away.

Irrevocable Trust- An irrevocable trust cannot be changed or terminated once it is created. A revocable trust becomes irrevocable when you pass away. This type of trust can protect your assets from creditors and lawsuits and reduce your estate taxes. If you ever file for bankruptcy, assets in an irrevocable trust cannot be included as they are not considered personal assets.

5.) What assets can be seized in a lawsuit?

Once a judgement has been entered against your favor, a creditor can serve an information subpoena. The information subpoena means you have to report any assets you own. Therefore, anything can be seized, ie. property, life savings, wages, cars, etc.

6.) Can I protect my assets before a lawsuit is filed against me?

Yes. Here are five things you can do to protect your assets before you get sued:

- Have adequate insurance- automobile liability insurance, homeowner’s/renter’s insurance, licensed professional insurance

- Form a trust to hold your assets

- Form a corporation or limited liability company to protect your personal assets from business creditors

- Add to retirement accounts

- Look up your state’s real estate protection laws. Some states have homestead exemptions that protect the equity in your personal residence.

7.) What is the difference between revocable and irrevocable trusts?

An Irrevocable trust can not be modified unless beneficiaries consent. By comparison, a revocable trust (living trust) can be changed at any time.

8.) Can protecting my assets make litigation easier?

If you plan ahead, yes, protecting your assets can make litigation easier. If you start asset protection planning after a lawsuit has been filed then it will be too late because it will be struck down in court as fraudulent conveyance meant to defraud a potential judgment creditor (or simply put fraud). There are multiple legal pathways one can take to protect your assets, some better for protection against lawsuits than others. If you have a high-risk job like a doctor or a contractor, consult with our attorney at the New York City law office of Inna Fershteyn to decide what asset protection plan will help you best.

9.) Do I need to create an asset protection plan?

Anyone can need an asset protection plan. Young business owners who want to protect their assets from risks; elderly who want to pass their assets down to their children or grandchildren; and those with a terminal illness who fear what will happen if they cannot pay their medical bills; all kinds of people with all kinds of assets need asset protection.

You will need asset protection, more urgently, if:

- You are about to be faced with a lawsuit

- You are in a profession where you could be heavily liable (doctor, lawyer, landlord, financial advisor, real estate developer, etc…)

- You are a debtor and/or grantor

- You have accumulated or are about to receive significant wealth (inheritance, business success)

- The value of your property has been reduced to be less than your mortgage

- You have excessive debt

Asset Protection Reviews

“In the past I’ve had less than pleasant experiences with lawyers, but I can honestly say that Inna is an excellent attorney. I went to her to set up a trust and she was extremely helpful, friendly, and reassuring. Turnaround time was extremely quick, and she gave me excellent advice for the future. I would highly recommend her services to anyone looking to get their estate planning done.” - Christine P.

“There is no one I would trust more than Inna to handle my family’s estate planning. She explained everything to us and answered all questions in the appointment that we had with details. She clearly knows what she is talking about, which made us feel that much more comfortable hiring her. The paperwork was all done very efficiently, not to mention her services were very fairly priced. If I ever need legal advice or any services for me or my family, I definitely will be coming to Inna again!” - Jen K.

“5 stars is not enough for this law office. Inna helped me with an extremely complicated problem when no one else could. We needed emergency estate planning and asset protection done to protect us from creditors. Inna was able to prepare an irrevocable trust and transferred our properties into the trust within 2 weeks time. I can not recommend her highly enough for any estate planning and asset protection law.” - Klavdiya Polovetskaya

Recent Asset Protection Articles