Trust and Estate Attorney NY: Experience & Compassion

Is your estate plan up to date? When was the last time you reviewed your wishes with an experienced trust and estate attorney?

In the state of New York, it is essential to have an estate plan in place in order to ensure a swift transition of assets from you to your beneficiaries. Estate planning is an important and necessary step to ensure that your wishes are followed by family members or loved ones you appoint. With an estate plan in place, fewer family conflicts are prone to occur as all your wishes will be laid out in the estate planning documents that best fit your needs. An estate plan provides many benefits besides the allocation of assets, including possible tax breaks, granting the power of attorney and any other wish you may have from a legal standpoint. The process of estate planning in New York is not always easy, but it is essential and having an experienced trust and estate attorney guide you in the drafting of an estate plan can pay dividends in ensuring your best interests are taken care of timely and efficiently.

Taking The First Step

Call us at (718) 333-2395 or email and we will be happy to assist you with all of your estate planning needs whether you need help with drafting a will, health care proxy, power of attorney, title and property deeds, trusts etc.

Benefits of Estate Planning:

Estate Planning has an array of benefits that many people don’t often consider. They are:

-

- Reduce Tax Burdens: Estate Planning allows you to reduce the tax burden your loved ones will encounter if your estate plan isn’t drafted.

- Designate Power of Attorney(s): Having a plan in place doesn’t just ensure what happens to your assets after your passing. In the case that you or your loved one become incapacitated, an estate plan designates a power of attorney (POA) who is able to make financial and medical decisions on your behalf. Designating a POA can save your loved ones time and money, while ensuring your wishes are followed.

- Make Retirement Less Stressful:You may be surprised to find out that having an estate plan could benefit you while you're still alive. Having an estate plan can ensure that you’re able to qualify for government assistance programs, particularly programs concerning medical care like Medicaid or Medicare down the line.

- Transfer Property Immediately to Relatives: Transferring property, whether it is personal property (bank accounts, belongings, etc.) or real property (real estate) into a trust agreement can ensure that your relatives are able to access your assets upon your death. This can help your loved ones pay outstanding bills and cover funeral expenses among other things.

If you’re in need of drafting or revising your estate plan, the Law Office of Inna Fershteyn is here to help. To schedule an appointment, give our office a call at (718) 333-2395.

Our Estate Planning Credentials

- Attorney Inna Fershteyn, the founder and principal of the Law Office of Inna Fershteyn has over 22 years of experience in trust and estate law.

- Ms. Fershteyn has worked with clients who are in need of time sensitive estate plans.

- Mrs. Fershteyn uses her knowledge of estate planning to set up advance directives, such as a health care proxy, power of attorney, and will for her elderly clients.

- Inna Ferhteyn works with clients and advises them to create a comprehensive financial plan in order to avoid paying for a nursing home, which could become costly.

- The Law Office of Inna Fershteyn has over 250 five star reviews. Here is a review that was recently written by one of our clients:

“I am writing this review on behalf of my parents who used this Trust and Estate Planning Law office to set up Revocable Living Trust, Will, Healthcare Proxy, Power of Attorney and transfer of their Brooklyn house into a trust. My parents were retiring and needed to put their affairs in order and I reserved to Google to see who the best elder care attorney is in NY. This office had the most positive reviews and I decided to give it a shot.

Let me tell you guys, I was pleasantly surprised. Having dealt with attorneys for my business my entire life, I was prepared for months and months of back and forth communication and planning and a huge bill. However [the] attorney and her team were so precise, clear and direct that my parents made a decision on the spot, gave all of their information and received [a] complete Trust and will package from [the] attorney within 2 weeks of time. And it was all done with very careful Corona-19 precautions. Masks were worn at all times, our temperature was checked and recorded into the book, hand sanitizer and gloves were available and [the] office was cleaned after every client and aired out for like 30 minutes. We were really happy and safe and can not recommend this Trust and Estate Planning law office high enough.” -Carmela R.

Why is an estate plan important?

A common misconception about estate planning is that it’s only for the rich, but this is not true. Estate planning is for everyone, whether you're young, older, rich, or not. When you start a family, it’s important to create an estate plan to make sure your children will be cared for by the person(s) of your choosing. For individuals who are getting closer to the age of retirement, estate planning should be a primary concern to ensure that your hard earned assets are protected from creditors and long-term care facilities. While the goals of estate planning may change for you depending on the stage of your life you’re in, the urgency of creating an estate plan doesn’t change

Ensuring that you have a trusted New York Trust and Estate attorney is crucial when drafting your estate plan. Each and every estate plan is unique in the way in which it pertains to the draftee. There are key documents that pertain to each estate plan though in order to grant certain powers to people of your choosing as well as serve your best needs and interests. These documents include a last will and testament: a legal document in which your last wishes are undoubtedly made clear and final, a Power of Attorney: a legal document which grants someone of your choosing the power to make decisions on your behalf and a health care proxy: a legal document that names somebody who is granted the power to make medically based decisions on your behalf. These documents are involved in every estate plan.

What are the differences between a Revocable and Irrevocable trust?

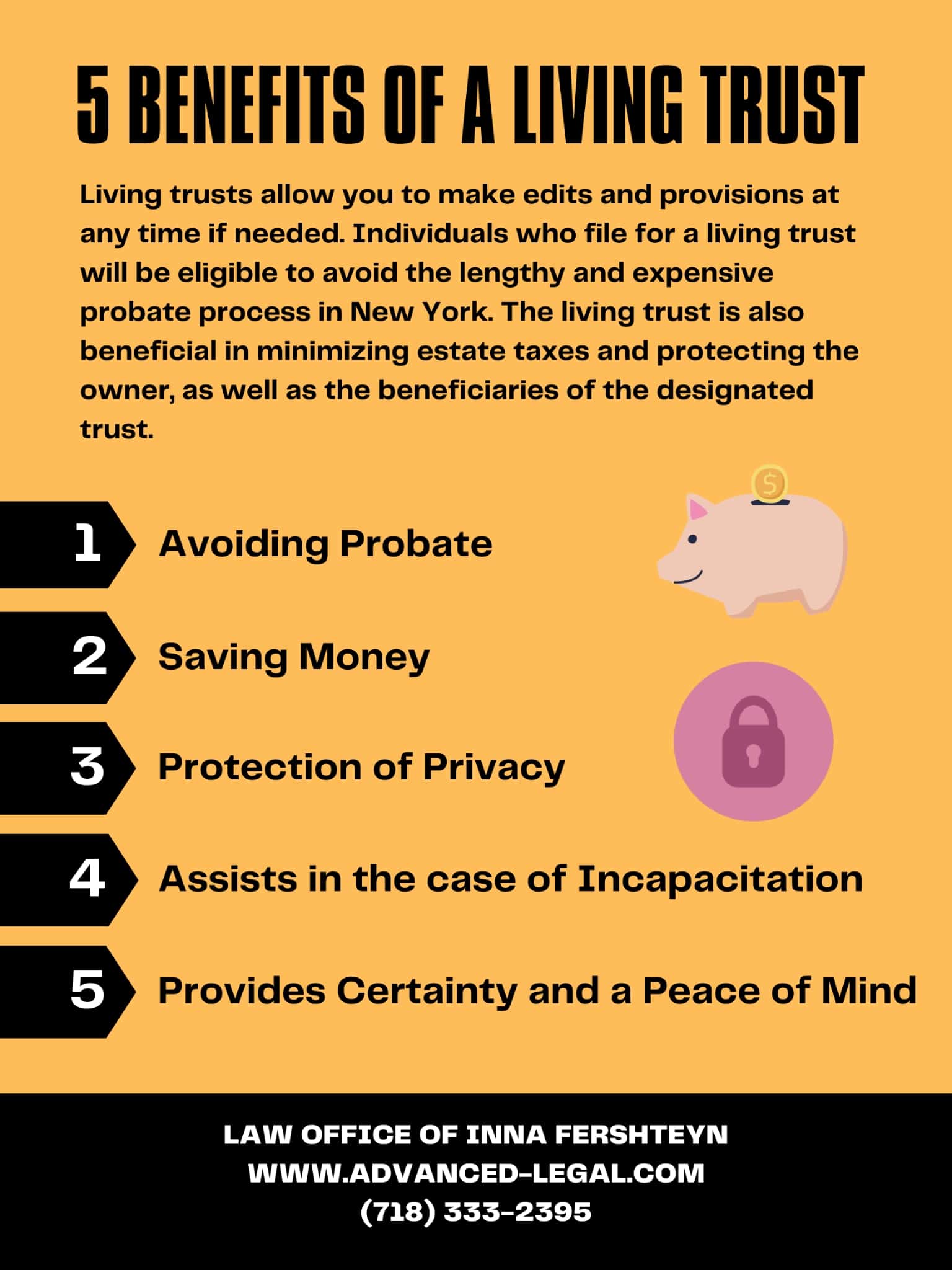

When drafting an estate plan it is essential to know about the different types of documents that you could draft as well as their upsides and downsides. In order to decide which plan best fits your needs. When drafting a trust, there are numerous types of trusts with the most common being either a revocable or irrevocable trust.

A revocable trust is a trust in which your final wishes are made clear and final. Your beneficiaries as well as your Power of attorneys are allocated, but they can be altered by you any time prior to your passing.

In an Irrevocable trust, you are provided with the same benefits as a revocable trust except it can not be altered. Although you can not alter said trust, an Irrevocable trust allows for numerous tax breaks as your assets are placed under their own social security identification number, granting them no longer in your possession. This may grant you medicaid eligibility, protect your assets from creditors and provide numerous other benefits that a revocable trust does not.

What questions should I ask an estate planning attorney during my initial consultation?

When scheduling a consultation it may be important to go into your consultation with knowledgeable questions in mind, in order to ensure that your attorney knows what is important to you specifically. Some questions to keep in mind when drafting your estate plan are as follows….

- Can a loved one sign legal documents if they have dementia?

- Are there provisions, specifically pertaining to power of attorney for people with dementia?

- Do my documents allocate successors or make use of co-agents?

- Is an Irrevocable trust necessary for me?

- What is the greatest threat to the security of my finances?

- What should I do with my original legal documents?

- What can I do to avoid costs associated with nursing homes?

- Do I need a Trust or a Will?

- What is better for me, a Revocable or Irrevocable Trust?

These are some of the most important questions to ask your attorney during your initial consultation as these questions ensure that your best interests are taken care of by your attorney and your estate plan is unique and catered to your specific needs.

What Documents are Essential to my Estate Plan?

Last Will and Testament: A last will and testament is a legal document in which your final wishes are made clear. This includes asset allocation as well as beneficiaries for said assets.

Health Care Proxy: A health care proxy is a legal document in which you name an agent (or multiple agents) who will be granted the power to make decisions regarding your healthcare in the case that you become incopacotated. These agents are trusted to do as you would in regard to making medical decisions such as deciding whether to stay on life support along with other key decisions in regards to your health.

Durable Power of Attorney: In New York state, a Durable Power of attorney is essential in the process of estate planning as it provides agents who are allowed to make decisions on your behalf in the case you can no longer do so. The agents listed have access to all your assets and can make decisions on what to do with them even when you are still able to, therefore it is crucial to choose trusted agents when drafting the durable power of attorney document.

Titles and Property Deeds: Titles and property deeds are essential in the New York state estate planning process as without these documents you can not prove ownership of the properties you are attempting to place into the estate plan of your choice, whether that be a trust or a will.

Estate Planning Case Studies:

- In February 2022, one of our clients scheduled an appointment at our office because their dad suffered a stroke and was in critical condition. Our client informed us that prior to his dad’s stroke, a Power of Attorney was executed, which meant that our client was able to sign an irrevocable trust agreement on his dad’s behalf and transfer his property into the trust as well. Due to the critical condition that our client’s dad was in, the drafting of the irrevocable trust and transfer forms for the property were time sensitive. After the initial consultation with the attorney, our client asked that all documents be created within the next. Within the next three days, all documents that we drafted were executed and the transfer forms needed to move property into the trust were sent for recording.

- A former client of ours moved to California and reached out to our office in March 2022 about needing to transfer her Manhattan property into a revocable trust. Since she was currently residing in San Diego, CA, her initial consultation was conducted via Zoom. After a course of action was established by our client and Ms. Fershteyn, our office began drafting a revocable trust, a new deed, and transfer tax forms to move the Manhattan condo into the trust. Once all documents were prepared, we asked our client to find a Notary Public licensed in California to notarize all documents. To assist our client in the execution of all her documents, we scheduled another Zoom meeting and were able to walk our client through all documents and successfully sign all necessary forms. After completing the execution, we asked our client to send us the executed transfer forms and new deed so we can send her new deed for recording. Within a week of our client’s document execution, the condo was transferred into the revocable trust our office drafted.

- In December 2021, a client wanted to find out what measures need to be taken in order to obtain Medicaid while protecting her assets at the same time. After her initial consultation with the attorney, we drafted an irrevocable trust for our client. After the trust was executed, our office created a separate tax ID for the trust and our client met with our Medicaid Specialist and Financial Advisor who works closely with the attorney to continue the process for her obtaining benefits.

FAQs about Estate Planning in NYC

How Long Does It Take To Go Through An Administration/Probate Proceeding?

In New York a probate proceeding can now take up to 2 years. Besides the time consuming nature of the probate process comes costs associated with this proceeding. Lawyer fees can total 10’s of thousands of dollars by the end of the probate proceeding, which can be avoided by drafting a trust instead of a will when planning your estate.

Is it too early to begin drafting my estate plan?

In short, it is never too early to begin planning your estate. Life is an unexpected, tumultuous journey in which the end is unknown. Anything can happen to anyone unexpectedly and it is important to ensure that your best interests are carried out long after your death. It is also important to have a designated power of attorney in place in case of medical or financial emergency, as well as numerous other benefits associated with planning of your estate.

Can I Transfer Property Title To Family Instead of Transferring Property in a Trust?

The answer to this question is yes, but it may not always be beneficial. This is because once the title is transferred to a family member, you no longer are in charge of making the decisions that have to do with this property. What this means is that your family member can now sell this property whether you would like to or not. Also this property is not protected from their creditors the same way it would be had it been transferred into an irrevocable trust. This means that creditors can claim “your” property and you can lose it in its entirety, unlike an Irrevocable trust which protects your property.

What assets can be transferred into a trust?

There are a variety of assets that can be transferred into a trust. These assets include both tangible and intangible items. What this means is that you can transfer assets such as properties, paintings, etc into a trust as well as intellectual property such as patents and other ideas. These assets can then all be allocated to beneficiaries of your choosing.

What happens if you or a loved one dies without an estate plan (intestate)?

If You or a loved one die without an estate plan all assets in your possession go through probate which then grants said assets to a parent if there are no descendants nor a spouse to grant the assets to. If a parent is no longer alive, the assets are then transferred to a sibling or child of a sibling if the sibling is no longer alive either.

Can all Trusts protect my assets from creditors?

Yes! An Irrevocable trust can protect your assets from creditors. When drafting an irrevocable trust your assets are placed under their own “social security” or identification number under the irrevocable trust. This means that they are no longer technically in your possession thus not allowing creditors to go after “your” assets that have been placed in the irrevocable trust.

Hire An Attorney to Make Plan that Carries Out Your Wishes

The Law Offices of Inna Fershteyn can help you put together your own Trust and Estate Plan and transfer property that you have in any of the 50 States into such trust.

Call us at (718) 333-2395 or email and we will be happy to assist you with all of your estate planning needs.