Trust and Estate Attorney NY: Experience & Compassion

Secure Your Legacy with a Trusted New York Estate Planning Attorney

Life is unpredictable, but your legacy doesn’t have to be. Without a well-structured estate plan, your hard-earned assets—and the future of your loved ones—could be left to the complexities of New York Probate Court, excessive taxation, or even disputes among family members. Whether you're looking to safeguard your wealth, establish a living trust, or ensure that your medical and financial wishes are honored, working with an experienced New York trust and estate attorney is the key to peace of mind.

At the Trust and Estate Planning office of Inna Fershteyn, we represent individuals, families, and business owners in all aspects of estate planning, asset protection, and elder law, with a focus on securing financial stability for future generations. With over 27 years of experience, Inna Fershteyn is a leading authority in New York estate law, trusted by over 260 five-star clients for her precision, efficiency, and deep expertise in asset protection, Medicaid planning, and elder law. Unlike other firms, we take a proactive, hands-on approach—crafting estate plans tailored to your unique financial situation, often delivering results in as little as two weeks. Don’t wait until it’s too late—take the first step toward security, clarity, and financial protection today.

Taking The First Step

Call us at (718) 333-2395 or email and we will be happy to assist you with all of your estate planning needs whether you need help with drafting a will, health care proxy, power of attorney, trust administration, probate, guardianship planning, or special needs trusts, etc.

Benefits of Estate Planning:

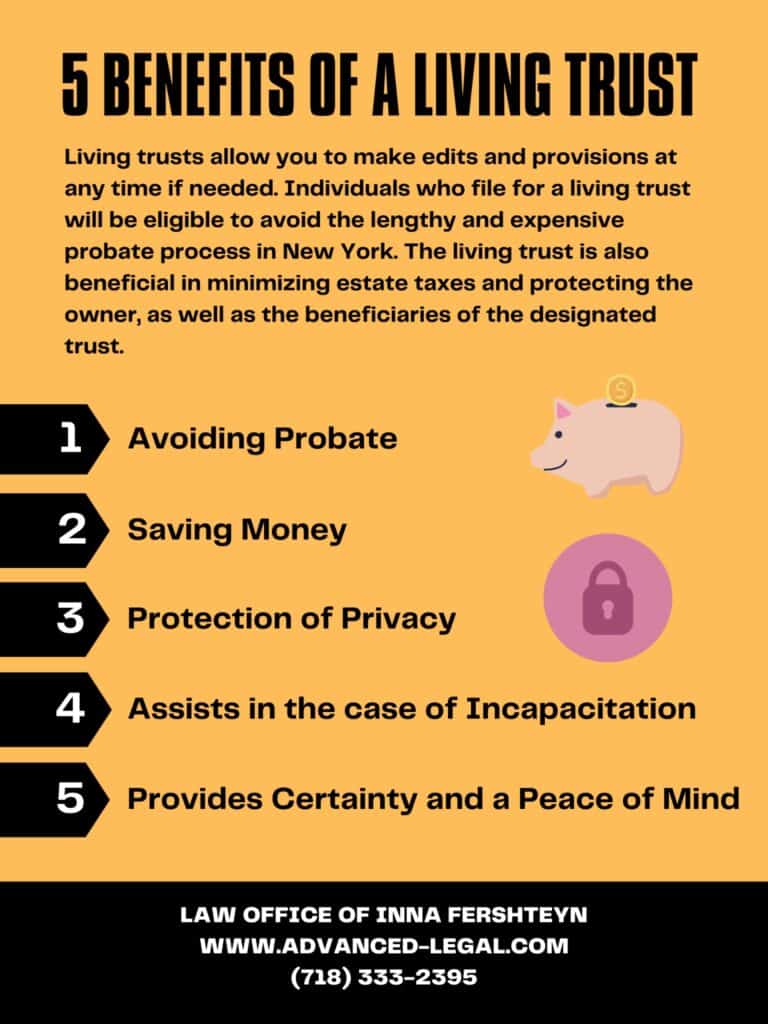

Estate Planning has an array of benefits that many people don’t often consider. They are:

- Reduce Tax Burdens: Consulting with an estate tax lawyer helps reduce the tax liabilities your loved ones may encounter without a strategic estate plan.

- Designate Power of Attorney(s): Having a plan in place doesn’t just ensure what happens to your assets after your passing. In the case that you or your loved one become incapacitated, an estate plan designates a power of attorney (POA) who is able to make financial and medical decisions on your behalf. Designating a POA can save your loved ones time and money, while ensuring your wishes are followed.

- Make Retirement Less Stressful: You may be surprised to find out that having an estate plan could benefit you while you're still alive. Having an estate plan can ensure that you’re able to qualify for government assistance programs, particularly programs concerning medical care like Medicaid or Medicare down the line.

- Transfer Property Immediately to Relatives: Transferring property, whether it is personal property (bank accounts, belongings, etc.) or real property (real estate) into a trust agreement can ensure that your relatives are able to access your assets upon your death. This can help your loved ones pay outstanding bills and cover funeral expenses among other things.

If you’re in need of drafting or revising your estate plan, the Law Office of Inna Fershteyn is here to help. To schedule an appointment, give our office a call at (718) 333-2395.

Our Estate Planning Credentials

- Attorney Inna Fershteyn, the founder and principal of the Law Office of Inna Fershteyn has over 27 years of experience in trust and estate law.

- Ms. Fershteyn has worked with thousands of clients who are in need of time sensitive estate plans.

- Mrs. Fershteyn uses her knowledge of estate planning and New York State trust laws to set up advance directives, such as a health care proxy, power of attorney, and will for her elderly clients.

- Inna Fershteyn works with clients and advises them how to avoid probate in New York by strategically using trusts and other legal mechanisms.

- She has personally assisted thousands of clients and worked on thousands of estate plans since founding the firm in 1998, ensuring hands-on experience in every case.

- The Law Office of Inna Fershteyn has over 260 five star reviews. Here is a review that was recently written by one of our clients:

“I have had an amazing experience working with Inna Fershteyn, a trust and estate attorney in NY. Dealing with the probate process during a time after my relative's death has been physically and emotionally exhausting. Especially with me living outside of NY and therefore being unaware of the process. That's why it was so important to find someone trustworthy and dependable to help me in this situation... That someone was Inna Fershteyn. What makes her stand out is her attentiveness and accessibility. She was unlike the other attorneys I have worked with before, because of her amazing communication. Whether it's through email responses, text messages or brief conversations Inna and her team consistently deliver great service! I recommend her without any hesitation!!!” – Ido L.

The Importance of Estate Planning

A common misconception about estate planning is that it’s only for the rich, but this is not true. Estate planning is for everyone, whether you're young, older, rich, or not. When you start a family, it’s important to create an estate plan to make sure your children will be cared for by the person(s) of your choosing. For individuals who are getting closer to the age of retirement, estate planning should be a primary concern to ensure that your hard earned assets are protected from creditors and long-term care facilities. While the goals of estate planning may change for you depending on the stage of your life you’re in, the urgency of creating an estate plan doesn’t change.

Ensuring that you have a trusted probate lawyer in NYC is crucial when drafting your estate plan. Each and every estate plan is unique in the way in which it pertains to the draftee. There are key documents that pertain to each estate plan though in order to grant certain powers to people of your choosing as well as serve your best needs and interests. These documents include a last will and testament: a legal document in which your last wishes are undoubtedly made clear and final, a Power of Attorney: a legal document which grants someone of your choosing the power to make decisions on your behalf and a health care proxy: a legal document that names somebody who is granted the power to make medically based decisions on your behalf. These documents are involved in every estate plan.

The differences between a Revocable and Irrevocable Trust in New York

When drafting an estate plan it is essential to know about the different types of documents that you could draft as well as their upsides and downsides. In order to decide which plan best fits your needs. When drafting a trust, there are numerous types of trusts with the most common being either a revocable or irrevocable trust.

A revocable trust is a trust in which your final wishes are made clear and final. Your beneficiaries as well as your power of attorney under NY law are allocated, but they can be altered by you any time prior to your passing.

In an Irrevocable trust, you are provided with the same benefits as a revocable trust except it can not be altered. Although you can not alter said trust, an Irrevocable trust allows for numerous tax breaks and can be used for Medicaid Asset Protection Trust (MAPT) planning, shielding assets from creditors and long-term care expenses. This may grant you medicaid eligibility, protect your assets from creditors and provide numerous other benefits that a revocable trust does not.

Book a Consultation with NYC’s Top Estate Lawyer Today!

Questions I Should Ask an Estate Planning Attorney During my Initial Consultation

When scheduling a consultation it may be important to go into your consultation with knowledgeable questions in mind, in order to ensure that your attorney knows what is important to you specifically. Some questions to keep in mind when drafting your estate plan are as follows….

- Can a loved one sign legal documents if they have dementia?

- Are there provisions, specifically pertaining to power of attorney for people with dementia?

- Do my documents allocate successors or make use of co-agents?

- Is an Irrevocable trust necessary for me?

- What is the greatest threat to the security of my finances?

- What should I do with my original legal documents?

- What can I do to avoid costs associated with nursing homes?

- Do I need a Trust or a Will?

- What is better for me, a Revocable or Irrevocable Trust?

These are some of the most important questions to ask your attorney during your initial consultation as these questions ensure that your best interests are taken care of by your attorney and your estate plan is unique and catered to your specific needs.

Essential Documents for my Estate Plan

- Last Will and Testament - A last will and testament is a legal document in which your final wishes are made clear. This includes asset allocation as well as beneficiaries for said assets.

- Health Care Proxy - A health care proxy is a legal document in which you name an agent (or multiple agents) who will be granted the power to make decisions regarding your healthcare in the case that you become incapacitated. These agents are trusted to do as you would in regard to making medical decisions such as deciding whether to stay on life support along with other key decisions in regards to your health.

- Durable Power of Attorney - In New York state, a Durable Power of attorney is essential in the process of estate planning as it provides agents who are allowed to make decisions on your behalf in the case you can no longer do so. The agents listed have access to all your assets and can make decisions on what to do with them even when you are still able to, therefore it is crucial to choose trusted agents when drafting the durable power of attorney document.

- Titles and Property Deeds - Titles and property deeds are essential in the New York state estate planning process for trust administration and asset protection. Without titles and property deeds you can not prove ownership of the properties you are attempting to place into the estate plan of your choice, whether that be a trust or a will.

Estate Planning Case Studies:

- Emergency Trust Planning Case: In February 2025, a client’s father suffered a stroke, leaving his estate in urgent need of planning. Fortunately, he had executed a Power of Attorney in NY, enabling his son to work with our firm to create an Irrevocable Trust. Within three days, all legal documents were prepared, signed, and recorded, ensuring asset protection and Medicaid eligibility.

- Remote Estate Planning Case: A client relocated to California in September 2024 but needed to transfer her Manhattan property into a Revocable Trust. Through virtual estate planning sessions, our firm guided her in drafting all necessary documents, coordinating notarization, and ensuring proper recording. Her trust was finalized within a week, preventing future probate complications.

- Medicaid Asset Protection Case: In April 2024, a client sought guidance on Medicaid eligibility and asset protection. Our firm swiftly drafted an Irrevocable Trust, secured a separate tax ID, and coordinated with financial advisors and Medicaid specialists to ensure seamless benefits application. This proactive planning protected the client's estate from long-term care expenses.

FAQs about Estate Planning in NYC

How Long Does It Take To Go Through An Administration/Probate Proceeding?

In New York a probate proceeding can now take up to 2 years. Besides the time consuming nature of the probate process comes costs associated with this proceeding. Lawyer fees can total 10’s of thousands of dollars by the end of the probate proceeding, which can be avoided by drafting a trust instead of a will when planning your estate.

Is it too early to begin drafting my estate plan?

In short, it is never too early to begin planning your estate. Life is an unexpected, tumultuous journey in which the end is unknown. Anything can happen to anyone unexpectedly and it is important to ensure that your best interests are carried out long after your death. It is also important to have a designated power of attorney in place in case of medical or financial emergency, as well as numerous other benefits associated with planning of your estate.

Can I Transfer Property Title To Family Instead of Transferring Property in a Trust?

The answer to this question is yes, but it may not always be beneficial. This is because once the title is transferred to a family member, you no longer are in charge of making the decisions that have to do with this property. What this means is that your family member can now sell this property whether you would like to or not. Also this property is not protected from their creditors the same way it would be had it been transferred into an irrevocable trust. This means that creditors can claim “your” property and you can lose it in its entirety, unlike an Irrevocable trust which protects your property.

What assets can be transferred into a trust?

There are a variety of assets that can be transferred into a trust. These assets include both tangible and intangible items. What this means is that you can transfer assets such as properties, paintings, etc into a trust as well as intellectual property such as patents and other ideas. These assets can then all be allocated to beneficiaries of your choosing.

What happens if you or a loved one dies without an estate plan (intestate)?

If You or a loved one die without an estate plan all assets in your possession go through probate which then grants said assets to a parent if there are no descendants nor a spouse to grant the assets to. If a parent is no longer alive, the assets are then transferred to a sibling or child of a sibling if the sibling is no longer alive either.

Can all Trusts protect my assets from creditors?

Yes! An Irrevocable trust can protect your assets from creditors. When drafting an irrevocable trust your assets are placed under their own “social security” or identification number under the irrevocable trust. This means that they are no longer technically in your possession thus not allowing creditors to go after “your” assets that have been placed in the irrevocable trust.

Hire An Attorney to Make Plan that Carries Out Your Wishes

The Law Offices of Inna Fershteyn can help you put together your own Trust and Estate Plan, transfer property that you have in any of the 50 States into such trust, create your own high net-worth estate planning strategy, including trusts, wills, and asset protection measures, and assist with how to avoid probate in New York, ensuring a smoother transfer of wealth to your beneficiaries.

Call us at (718) 333-2395 or email and we will be happy to assist you with all of your estate planning needs.

New York City Downtown Office Location

Trust and Estate Planning Law Office

310 East 2nd Street, Suite 9A

New York NY 10009

Phone: (718) 333-2395

Attorney: Inna Fershteyn