Shielding Seniors from Online Romance Scams

Life hits you fast when the online partner that you are in a romantic relationship with runs off with not only your dreams of marriage, but also $39,000 and your pension. This happened to Kate Kleinert, a 69 year old widow who found herself lonely during COVID. Her encounter on Facebook with an alleged Norwegian doctor dispatched to Iraq resulted in her losing not only her hopes for love, but also a large sum of money. Unfortunately, Kate's story is just one of many in a growing trend of romance scams that have cost elderly individuals a staggering $304 million, a number significantly higher than it was five years ago. Let's delve into the reasons behind this surge in scams and the serious repercussions they bring.

What do romance scams look like?

While young people can also fall victim to online scams, older individuals, particularly those over the age of 40, are more susceptible to romance schemes. The elderly, including widows, widowers, and recent divorcees, are especially vulnerable to emotional manipulation due to isolated living circumstances. Scammers prey on this vulnerability, knowing that older adults usually have more financial resources, such as retirement funds, investments, and savings, making them attractive targets. These online romancers will say anything to exploit their victims' emotions and financial situation, even luring them with the promise of marriage to lower their defenses.

Typically, the victims of romance scams meet their phony lovers on dating websites or apps. The scammers use pictures of random people they find online to create fake identities and initiate conversations. They engage in intimate chats and exchange photos, leading the victims to believe they are in a genuine relationship. Once they have gained the victim's trust and affection, the scammers create a story about a supposed problem that requires a certain amount of money to be solved. Out of love and a desire to help their supposed partner, the victim sends money. However, this is rarely a one-time occurrence. The scammers continuously create new problems that require more money, draining their victims emotionally and financially until there is nothing left. Some victims find themselves endlessly manipulated, even after they have exhausted their funds. This is exactly what happened to Kate Kleinert.

The European Lover

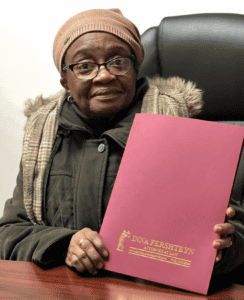

In Kate's case, she met a person posing as a Norwegian doctor named Tony in 2020. Kate, a 69-year-old widow, made a fateful decision when she accepted a Facebook friend request from an attractive stranger. After a few months of daily messaging, Tony asked her for money. Although it should have been a red flag, Kate obliged, and over time, she sent nearly $39,000 in gift cards to Tony. He depleted her savings, her deceased husband’s life insurance, her pension, and money from Social Security. The financial loss was heartbreaking, but what hurt her even more was the loss of the love and family she thought she was going to have with Tony.

Unfortunately, this deception doesn't stop with Kate; many older adults have fallen victim to these scams. In a recent NYT article, Michael Delaney, an elder law attorney in Chicago, recounts stories of adults taking out mortgages on their homes, borrowing money from neighbors, and emptying their retirement accounts to maintain fraudulent connections. The harm persists until a concerned loved one intervenes. However, when victims report the incidents to authorities, they often receive little help as the scammers frequently use foreign IP addresses, making it difficult for law enforcement to track them down. The aftermath leaves victims emotionally devastated and financially devastated, seeking alternative sources of support, like GoFundMe campaigns, to make ends meet. Even after Kate changed her online privacy settings, months later Tony managed to reach back out to badger her for money. He told her, “I know you have money. I saw your GoFundMe page”.

Tips to Avoid a “Tony” Mishap

So, how can we protect ourselves and our loved ones from falling into a "Tony" mishap? First, we should spend quality time with our older loved ones, especially those who might feel isolated or are grieving the loss of a partner. By offering companionship, we can help reduce their vulnerability to romance scams. We should also educate them about the risks of online relationships with strangers and help them spot potential red flags.

Additionally, research should be done to verify the identity of potential online partners. Video calls are a great way to confirm someone's identity, but if that's not possible, checking for consistent online profiles and reverse image searches on Google can help identify fake accounts. If a personal social media account has a lot of information posted within a short timespan, chances are that the profile is a ruse.

Above all, trusting our instincts is vital. If something feels off or too good to be true, it probably is. Being cautious, especially when asked to send money to someone you haven't met in person, is essential. Seeking a second opinion from a trusted friend or family member can help avoid falling victim to these scams.

Taking everything into account, online romance scams pose a significant threat, particularly to vulnerable individuals like Kate Kleinert. The emotional and financial toll inflicted by these heartless fraudsters highlights the need for increased awareness and caution. To protect our loved ones, especially older adults, spending quality time with them and promoting digital literacy can help reduce the risk of falling prey to these manipulations. By fostering open conversations and trust, we can create a safer online environment where genuine connections flourish, shielding hearts from the deceptive tactics of romance scammers. If you and your loved one find yourselves in the midst of a romance scheme, please call the Trust and Estate Planning Law Office at (718) 333-2395 to take your next steps.