Elder Law Attorney in New York City

About Our Elder Law Practice?

Our Elder Law Practice offers legal counsel to New York City seniors on various matters, including:

- Health care planning

- Medicare/ Medicaid planning

- Elder rights

- Guardianships

- Estate administration

- Estate planning

- Wills and trusts

- Special needs trusts

- Short-term planning

- Home care aid Medicaid

Attorney Inna Fershteyn, Esq., one of the top-rated elder law attorneys in New York City, has built a strong reputation by advocating for senior clients and addressing the legal needs of their families.

How Can An Elder Law Attorney Help?

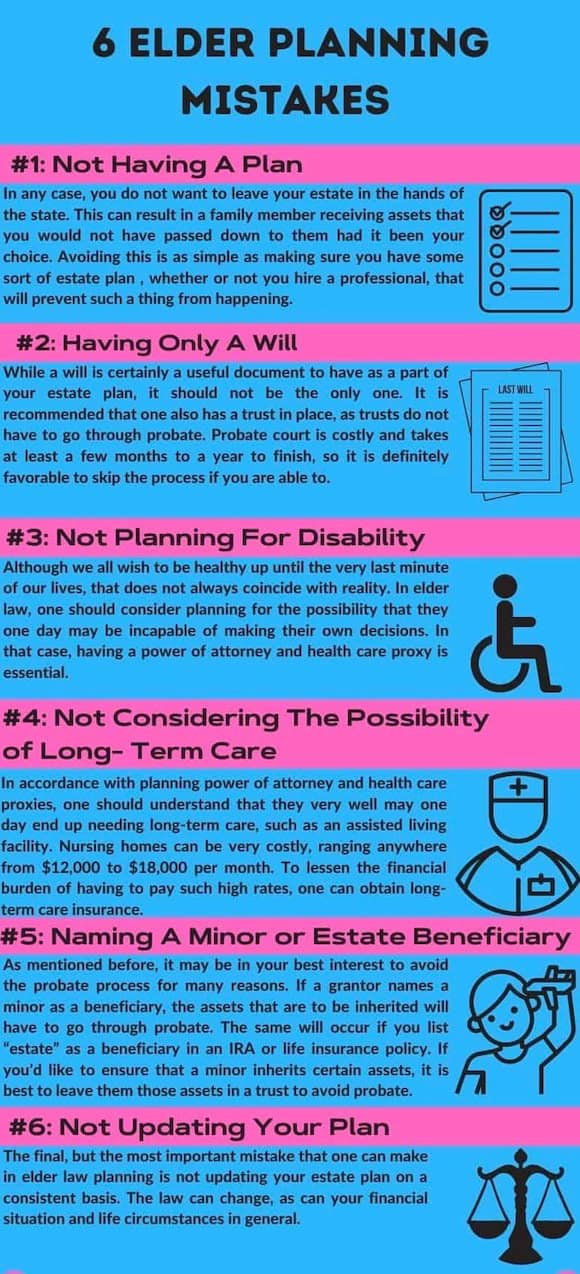

As individuals age, questions about assets, estates, finances, health care, and long-term care become pressing. Elder law is complex and continually evolving, making it essential to consult with an experienced elder law attorney. Some key concerns that an elder law attorney can address include:

- Estate Planning- Determining the best way to manage and distribute your assets.

- Preparing Documents- Deciding between a will, trust, or other estate planning documents.

- Long-Term Care Planning- Ensuring your care is paid for and managed effectively.

- Incapacity Planning- Ensuring that your wishes are followed if you become incapacitated.

- Legal Guardianship- Appointing someone to take care of you if you are unable to do so.

- Short-term planning: Handling immediate legal and financial concerns and needs effectively for seniors.

What is Elder Law?

Elder Law focuses on:

- Retirement planning

- Disability planning

- Medicaid services

- Nursing home cost concerns

- Short -term planning

Elder Law attorneys in the New York City area are specialists in the needs of seniors, particularly regarding estate planning, asset protection, Medicaid planning, and family law.

Essential Documents for Elder Plans?

Elder Law attorneys can help set up important advance directives, including:

- Health Care Durable Power Of Attorney: This document designates a trusted individual to make decisions on your behalf.

- Living Will: This document outlines your medical preferences at the end of life.

- Will/ Revocable Trust: Most people draft wills, which specifies how your assets should be handled after death. However, wills must go through probate, a time consuming process. As a result, some people prefer to use a revocable trust, potentially bypassing the probate process.

- Medicaid Home Care Aid: Ensuring that seniors receive adequate home care services under Medicaid.

What Documents Should Be Executed in my Elder Plan?

An experienced elder planning attorney can help you:

- Avoid costly nursing home fees through comprehensive financial planning.

- Qualify for Medicaid while maintaining an income through a Pooled Income Trust.

- Protect your assets with a well-prepared estate plan.

- Prepare a Medicaid Home Care Application.

- Obtain Medicaid Home Care Aid which will help seniors access home care services covered by Medicaid.

- Establish Guardianship of disabled adults.

Long Term Care and Other Considerations

Long Term Care

Long-Term Care includes services designed to meet medical and personal care needs over an extended period. It is often costly, with nursing homes or assisted living facilities charging more than $5,000 per month. Many families struggle to be able to afford these expenses, leading them to careful financial planning and consideration of insurance options such as long-term care insurance.

Pooled Income Trust

A Pooled Income Trust is a legal structure that helps individuals with disabilities and senior citizens seeking public assistance for long-term care costs to qualify for government benefits while preserving their monthly income for living expenses. By depositing excess income into the trust, beneficiaries can meet Medicaid income eligibility requirements without sacrificing their standard of living.

Adult Guardianship

Adult Guardianship involves a court ruling on an adult’s ability to make rational medical and financial decisions. If considered to be incompetent, then a guardian is appointed to handle these matters on their behalf. The process can be complex and requires thorough documentation and legal proceedings to ensure that the individual’s rights are protected.

How to Find the Right Elder Care Lawyer

When hiring an elder law attorney, you need to make sure that they are a good fit for you. You need to make sure that you’re comfortable with whomever you choose to hire, because they will be someone you will have to work closely with. Initial consultations are crucial for understanding your case and addressing any questions or concerns.

Office Address and Contact Information

The Law Office of Inna Fershtyen

1517 Voorhies Ave, Suite 400

Brooklyn, NY 11235

Phone: (718) 333-2394

New York CIty Areas Served

Inna Fershteyn, with over 22 years of experience, serves clients in Brooklyn, Manhattan, Bronx, Queens, Staten Island, and the Tri-State area. For elder planning, contact the office to schedule a consultation.

FAQs Regarding Elder Law Attorney

I am ready to retire in NYC, how can I be eligible for Medicaid and Home attendant services?

To be eligible for Medicaid and home attendant services in NYC, you must meet specific income and asset limits, with the 2024 thresholds being around $1,732 per month for income and $31,175 in assets for a single person. If your income exceeds this limit, you may still qualify through a "spend down" program, where excess income is used for medical expenses. Additionally, you must demonstrate a need for assistance with daily activities, which will be assessed by a medical professional.

What is the role of an Elder Law Attorney?

An elder law attorney specializes in legal issues affecting older adults, including estate planning, Medicaid planning, guardianship, and elder abuse prevention. They help navigate the complex legal landscape to protect the rights, assets, and well-being of elderly individuals.

How can I protect my assets while qualifying for Medicaid?

Strategies to protect assets while qualifying for Medicaid include creating irrevocable trusts, transferring assets within the Medicaid look back period, and using annuities or spend-down methods. Consulting with an elder law attorney is essential to develop a plan that complies with Medicaid rules and preserves your financial security.

What is a Power of Attorney and why is it important?

A Power of Attorney (POA) is a legal document that allows you to designate someone you trust to make decisions on your behalf if you become unable to do so. This can include managing your finances, paying bills, or making healthcare decisions. Having a POA in place is crucial for ensuring that your affairs are handled according to your wishes and can prevent the need for court appointed guardianship. It's a key component of elder law planning.

What is a Private Settlement Agreement in Elder Law?

In Elder Law, a private settlement agreement is a contract between two parties that avoids court intervention by settling their differences amicably. By going through a private settlement agreement, parties can save time, reduce legal costs, and maintain their privacy, all while achieving a mutually acceptable resolution that preserves family relationships and respects the wishes of the elders involved.

Who is considered an Elder by Law?

While there is no legal benchmark that exists to be classified as an elder, Elder Law usually involves clients over the age of 60.

What is Elder Abuse?

Elder abuse includes various forms of mistreatment, including:

- Physical abuse: The infliction of physical harm on an elderly person. This includes force feeding, excessive drug use, physical restraint, and holding someone against their will (false imprisonment).

- Emotional abuse: An act that causes anguish, distress, or emotional pain, such as verbal assault, humiliation, harassment, and treating elderly people like children.

- Sexual abuse: Acts of engaging in non-consensual sexual activity with an elderly person, especially those unable to give or understand the concept of consent.

- Neglect/Self-Neglect:

- Neglect: When a caregiver intentionally withholds care or is unable to provide adequate care.

- Self-Neglect: When an elderly person is unable to provide themselves with necessary food, water, and hygiene.

- Financial Abuse: Financial Abuse refers to the act of defrauding elderly individuals of their money or assets. Common perpetrators of financial abuse include phony telemarketers and con artists.

- Abandonment: When a caregiver deserts a vulnerable elderly person, either in public places or by refusing to fulfill their caregiving responsibilities.

What is Undue Influence in Elder Law?

Undue influence in Elder Law occurs when an individual exerts pressure on another person to act against their wishes in favor of the influencer. This can take place through deception, threats, and isolation. Elderly individuals, particularly those who are ill, are more susceptible to undue influence.

How can I recognize signs of Elder Abuse?

Common signs of elder abuse include:

- Unexplained injuries or bruises

- Sudden changes in behavior or mood

- Withdrawal from social activities

- Poor hygiene or untreated medical conditions

- Unexplained financial transactions or missing assets

What should I do if I suspect Elder Abuse?

If you suspect elder abuse you should report it by contacting local adult protective services, the police, or a trusted legal professional. You should also document it and keep detailed records of any signs or incidents of abuse. Also, make sure to seek help and consult an elder law attorney for legal advice.

What legal protections are available for elderly individuals?

Legal protections available for elderly individuals include:

- Protective Orders: Court orders to prevent abusers from contacting the victim.

- Guardianship: Appointing a guardian to manage the personal and financial affairs of an incapacitated elder.

- Financial Safeguards: Legal measures to protect assets, such as establishing trusts or powers of attorney.

What are some of the resources available for Elder Abuse victims?

- National Center on Elder Abuse (NCEA): NCEA provides information and resources to help prevent elder abuse.

- Local Adult Protective Services (APS): APS investigates reports of elder abuse and offers support services.

- Elder Law Attorneys: Offer legal advice and representation for elder abuse cases.

Elder Law Case

A former client who was diagnosed with early stage dementia was concerned about managing their finances and securing long term care. They own a home and have some savings but want to qualify for Medicaid while protecting their assets. To address these issues, they consulted with our elder law attorney who recommended setting up an asset protection trust and establishing legal documents like a durable power of attorney and healthcare proxy. The attorney also advises monitoring care to prevent potential abuse and ensure the individual receives appropriate support. This plan helped this client safeguard their assets, ensure Medicaid eligibility, and protect themselves against financial exploitation.

Medicaid Eligibility Case

An elderly client consulted attorney Inna Fershteyn for Medicaid benefits. After evaluating the client’s assets, attorney Inna Fershteyn created a Pooled Income Trust to move assets into a trust account, enabling the client to qualify for Medicaid benefits.

Home Care Hours Appeal Case

After receiving a reduction of homecare hours from a home care agency, an elderly client sought Inna Fershteyn’s help. Inna Fershteyn gathered evidence, submitted an appeal, and successfully prevented the reduction of home care hours.