New York City Asset Protection Attorney–Protect Your Assets Now

In New York City, over 10,000 lawsuits are filed every year. What’s at stake? The hard earned assets and property your family owns. We live in a highly litigious society, and as a result, people can be presented with a lawsuit or divorce seemingly out of nowhere. To prepare and protect yourself, you will want to have a skilled asset protection lawyer in your corner who understands your overall estate planning objectives to ensure that you have both lawsuit protection strategies and legal asset protection instruments in place.

Based in New York City, The Law Office of Inna Fershteyn provides expertise in asset protection planning for Clients throughout New York City and beyond. We make sure you are:

- Protecting your accumulated wealth and assets proactively

- Protecting your money from creditors legally

- Protecting your money from impending or future lawsuits

Don’t wait until it’s too late. Plan and protect what you’ve spent a lifetime building right now. Call (718) 333-2395.

It’s important to note that we will help you protect your assets, not hide them.

To protect your assets, there are legal strategies to properly protect yourself. Both estate planning and tax planning are essential to protecting your assets within the law.

- An experienced attorney will review your assets and help you develop an estate plan that will reduce the risk of your assets being taken by third parties in a litigation scenario.

- Another legal option is working on your tax planning. Every legal path varies when it comes to tax planning so it is important to know how your assets will be taxed before creating your plan. Our New York City asset security lawyer will work with you to analyze your financial situation and develop a plan to ensure that your money is well spent. The Law Office of Inna Fershteyn can help you through financial security legal services in NYC.

Why Now Is The Time to Consult An Attorney

Don’t wait for potential lawsuits and other situations to arise. Hiring an asset protection attorney in NYC now is one of the most important things you’ll ever do. If you do, by the time creditors, third parties, litigious entities, and financial aggressors come after everything you own or when you are faced with a legal battle, you’ll already be in a well secured financial position. With laws constantly changing, it’s important not to rely on online resources to protect your assets. Speak with a local, experienced attorney who is up to date on recent New York laws can create a wealth preservation plan that is unique to your own circumstances.

Meet Your NYC Asset Protection Attorney: Inna Fershteyn, Experienced Lawyer

When protecting your assets, experience matters. Inna Fershteyn is a trusted New York City attorney with over 27 years of legal experience, helping clients secure their estates, have control over their hard earned assets, protect assets from creditors, and even help clients obtain Medicaid through financial shielding.

She is well known for a hands-on approach, working closely with the Medicaid office to secure favorable outcomes for clients. This depth of experience allows Ms. Fershteyn to craft customized legal strategies that address each client’s unique financial and family situation. Using advanced strategies such as irrevocable trusts and asset protection trusts, she helps clients legally protect homes, savings, and estates from nursing home costs, lawsuits, and creditors. She regularly navigates New York Medicaid laws and monitors developments from the New York Department of Financial Services (DFS) and NYC Bar Association Trust and Estate Section to ensure compliance and effectiveness.

Clients turn to Ms. Fershteyn for guidance on complex legal planning, especially when facing high-stakes issues such as long term care, estate planning, or protecting generational wealth. Her firm serves clients throughout New York City’s five boroughs, including Brooklyn, Queens, the Bronx, Manhattan, and Staten Island, as well as key financial areas like Wall Street, Midtown, and Lower Manhattan.

What is Asset Protection Planning?

Asset protection planning is a proactive legal process that safeguards your wealth from creditors, divorce, lawsuits, or judgments. This action will ensure a smooth transition of your assets to your heirs with minimal taxes and without court proceedings. Wealth preservation strategies involve a series of legal and lawful techniques that can deter or minimize an unfavorable outcome from a lawsuit. It can also give you settlement negotiation power, but most importantly it can help prevent the seizure of your assets in the event of an unfavorable judgment. Examples of legal paths include establishing asset protection trusts, establishing LLCs, equity-stripping strategies, and working with a trust formation attorney NYC to customize your plan.

The Types of Assets Our Law Firm Reviews

The types of assets our firm reviews include a wide variety. We review assets such as bank accounts, real estate, tangible property, investment accounts, LLCs, stocks and bonds, and life insurance.

Bank accounts–also known as cash accounts such as checking, savings, money market, and CDs. However, you should check with your financial institution before you try to transfer an account or saving certificate.

Real estate–this includes personal residences and investment properties. Transferring real estate into a trust means you will have to transfer the legal title to your trustee. You will have to execute, notarize, and record a new deed in the name of your trust.

- Mortgage-if there is a mortgage on any of your properties, it is advisable to contact the mortgage company before initiating the transfer.

- Title insurance & homeowner’s insurance-when putting your home in a trust, one of the things that you must do first is add the trust to your house insurance policy and any other applicable umbrella policies.

Tangible property–Any physical object you own can be considered. For example, motor vehicles, boats, airplanes, firearms, pets, horses, and tools. Personal effects can be considered too such as jewelry, clothing, books, furniture, antiques, paintings, etc.

Investment accounts–Similar to bank accounts, you can transfer your investment accounts into a trust. It is advisable to check if you named beneficiaries in your investment accounts and if those beneficiaries match your trust.

LLCs–If you are going to transfer any limited liability companies, you have to register any partnerships in the name of the trustee because they require the consent of some or all partners.

Stocks and bonds–Any stocks issued in certificate form must be registered in the trustee’s name and you need to issue a new certificate. Any bonds must also be registered in the name of the trustee and a new bond will need to be issued.

Life insurance–You can change the ownership of your life insurance policy to your trust. It will give your successor trustee legal authority over the policy. If you ever become mentally incapacitated, they can borrow against its cash value to pay for your care.

Protecting Assets from Nursing Homes and Creditors

One of the most urgent reasons people seek asset protection in NYC is to shield their life savings from the rising cost of long term care. In New York, a nursing home can be very costly and as a result drain your entire estate.

That’s why Medicaid planning is a critical component of any comprehensive legal asset protection strategy in New York. Setting up irrevocable Medicaid asset protection trusts, also known as MAPTs, which remove assets from your name while still allowing you to benefit from them indirectly, can help preserve your wealth. When structured correctly these trusts can legally shield your property from nursing home costs under New York State Medicaid eligibility rules and protect you under guidance from the New York State Unified Court System.

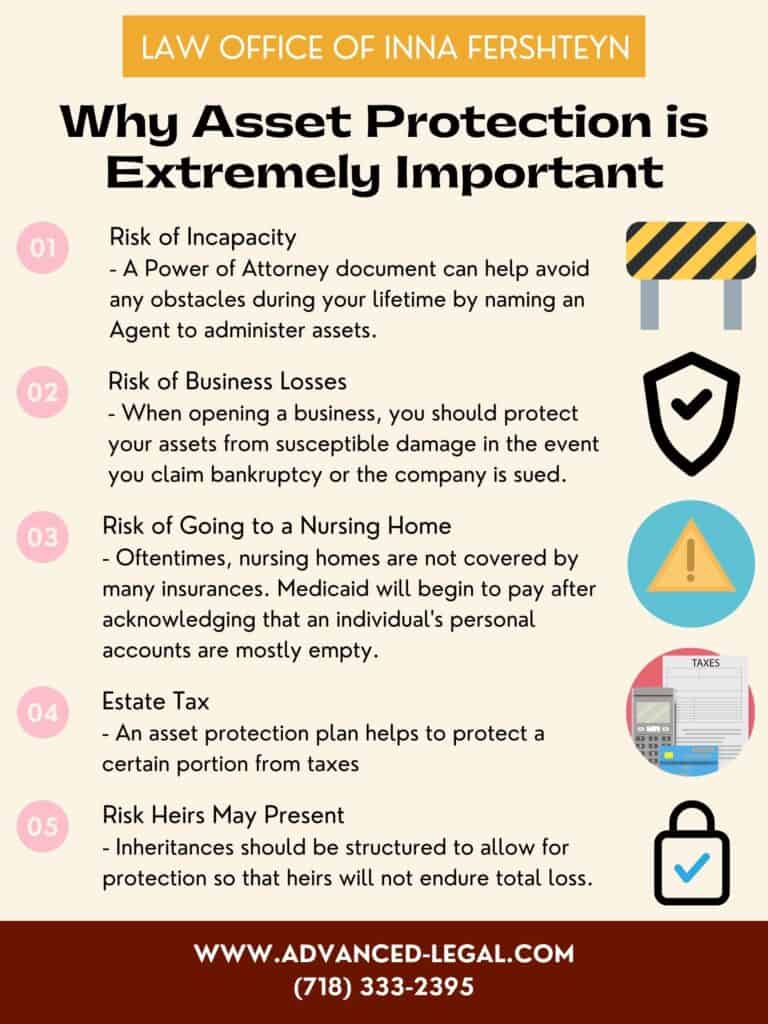

Why Your Assets Are Susceptible and Vulnerable

If you don’t properly protect your assets, they may be susceptible and vulnerable to creditors or can be lost quickly in the midst of a lawsuit or bankruptcy. In order to make sure your assets aren’t vulnerable to these circumstances, you should meet with an experienced estate planning lawyer who can give you strategies and approaches to protect yourself from creditors, who may have claims against your assets in the future. Many times, the biggest creditor that could go after your assets is a former spouse. In the event of a divorce, an asset security attorney in NYC will make sure to prevent this from happening.

Top 10 Asset Protection Planning Strategies You Can Use To Protect Yourself from Creditors or a Lawsuit in New York

There are many different ways of protecting your assets from creditors or lawsuits. Some of the most common strategies are:

- Asset Protection Trusts

These irrevocable trusts remove assets from your ownership, placing them under trustee control, which legally shields them from creditors and lawsuits when structured properly in advance. - Revocable and Irrevocable Trusts

While revocable trusts avoid probate, irrevocable trusts offer protection by taking assets out of your taxable estate and beyond the reach of most legal claims, making them ideal for long term asset shielding. - Living Wills

A living will ensure control over medical decisions and can prevent unwanted court interventions that might expose your estate to unnecessary legal proceedings. - Special Needs Trusts

Designed to hold and protect assets for a disabled beneficiary without affecting their government benefit eligibility, these trusts preserve wealth while complying with Medicaid and SSI rules. - Medicaid Planning

Strategic transfers and the creation of Medicaid Asset Protection Trusts (MAPTs) allow individuals to qualify for long term care without spending down their entire estate, shielding assets from nursing home costs. - Elder Law Planning

This strategy incorporates trusts, gifting, and care contracts to protect an aging person’s assets from both long term care expenses and opportunistic creditors, while preserving eligibility for public benefits. - Corporate Structures

Forming LLCs separates personal and business assets, creating liability barriers that make it harder for creditors to seize your personal property in a business related lawsuit. - Retirement Accounts

Many qualified retirement plans (like IRAs) are protected under federal and state law from creditors, making them effective vehicles for wealth growth and protection. - Guardianships

Establishing legal guardianship with a trust can protect the finances of a minor or incapacitated adult from mismanagement or third party claims, ensuring that assets are used only for their intended benefit. - Generation-Skipping Trusts

These trusts allow assets to bypass one generation and transfer directly to grandchildren, reducing estate taxes and protecting wealth from being diminished by a beneficiary’s creditors or divorces.

Who Needs Asset Protection?

Asset protection is essential for anyone with assets that could be exposed to legal, financial, or medical risks. You may benefit from asset protection if you are:

- Business owners who want to separate personal and business liabilities

- Doctors, lawyers, and other professionals exposed to malpractice or lawsuits

- Real estate investors with multiple properties or high property value

- High net worth individuals and families seeking to preserve generational wealth

- Seniors or retirees planning for Medicaid and nursing home expenses

- Landlords or contractors frequently dealing with tenant or worksite disputes

- Entrepreneurs with valuable intellectual property or startup assets

- Individuals going through divorce or concerned about property division

- People expecting a large inheritance or financial windfall

- Parents of children with special needs who want to ensure long-term care and benefits

Asset Protection Strategies for 2025

Asset protection in 2025 has become more sophisticated and urgent than ever. With rising litigation across New York City, new federal regulations, and aggressive creditor tactics, relying solely on traditional methods is no longer enough. Modern strategies require layering legal tools, adapting to regulatory trends, and anticipating risks before they arise.

2025 Litigation and Regulatory Risks

- Significant increase in real estate related lawsuits in NYC, targeting landlords, developers, and property owners.

- Expanded FinCEN reporting affecting LLCs and trusts.

- Closer scrutiny from the New York State Department of Financial Services (DFS) regarding Medicaid related asset transfers.

- More civil court challenges involving fraudulent and improper asset transfers.

Traditional vs. Modern Asset Protection Strategies

Traditional asset protection strategies like revocable trusts and basic LLCs were once enough to avoid probate and separate business from personal assets. But in 2025, modern threats like aggressive litigation and tighter regulations require more advanced tools. Modern asset protection uses layered strategies such as irrevocable trusts, equity stripping, Domestic Asset Protection Trusts (DAPTs), and offshore planning to provide stronger, more durable protection against creditors and lawsuits.

Comparison Table: Trust Types for Asset Protection

| Trust Type | Primary Purpose | Asset Protection Level |

| Revocable Trust | Avoids probate and allows full control | Low – assets are still accessible to creditors |

| Irrevocable Trust | Removes assets from estate for tax and Medicaid planning | High – assets no longer in your name |

| Domestic Asset Protection Trust (DAPT) | Allows self settled trust protection (varies by state) | Moderate – not recognized in NY, but effective in combination planning |

| Offshore Trust | Formed in jurisdictions with strong asset protection laws | High – difficult for U.S. courts to penetrate |

Advanced Techniques Gaining Traction in 2025

Medicaid Asset Protection Trusts (MAPTs):

One of the strongest tools to shield assets from nursing home costs, MAPTs remain effective in 2025, especially when created more than five years before applying for Medicaid.

Offshore Trusts:

These remain an advanced but powerful strategy for shielding significant assets from U.S. based litigation, particularly in jurisdictions with strong asset protection statutes.

NYC Specific Legal Updates

- NYC courts have adopted a stricter stance on last minute transfers, especially when made before divorce, litigation, or bankruptcy.

- Proposals from the NYC Bar Association Trust & Estate Section suggest potential future limits on MAPTs and elder focused trusts.

- High liability professionals such as physicians and developers are under increased threat of litigation and are advised to restructure asset holdings proactively.

What You Should Do in 2025

If you’re wondering what steps to take this year, start by reviewing whether your current plan accounts for modern risks. Effective 2025 strategies will:

- Use MAPTs to protect against nursing home costs

- Ensure compliance with FinCEN and IRS asset protection rules

- Work within the framework of the New York State Unified Court System to avoid litigation traps

Asset Protection Service Areas

Our asset protection attorney is based in Brooklyn, NY, proudly serving clients throughout the New York City area, including all five boroughs: Manhattan, Brooklyn, Queens, The Bronx, and Staten Island. We also assist clients in key financial hubs such as Wall Street, Midtown, and Lower Manhattan, as well as throughout Long Island (Nassau and Suffolk Counties) and the greater New York Metro area. To find out how the Law Office of Inna Fershteyn can help you, give us a call at (718) 333-2395.

Asset Protection Case Studies

- In January of 2025, a retired couple in Manhattan approached our office concerned about the rising cost of future nursing home care. They had over $1 million in combined assets, including two properties. After a detailed review, our attorney recommended the creation of a Medicaid Asset Protection Trust (MAPT). The couple transferred one of their properties and a portion of their savings into the trust. This strategy allowed them to preserve their estate while still preparing for Medicaid eligibility down the line.

- In August of 2024, a client in Brooklyn recently remarried and wanted to make sure her children from a prior marriage would receive her estate, while also providing for her new spouse. We created a customized irrevocable trust with staggered distributions. This allowed her spouse to remain in the marital home during his lifetime, while ensuring that the home and remaining assets would pass to her children after his death. The trust structure protected her wishes and avoided the risk of a future will contest.

- In May 2024, a client in Queens received an inheritance from a relative and was concerned about potential future lawsuits related to her work in private healthcare. She wanted to make sure the inherited funds would remain protected regardless of her professional risk or any personal financial challenges down the line. We helped her establish an irrevocable trust, placing the inherited funds outside of her personal estate. By doing so, we ensured the assets would be protected from future creditors, malpractice claims, and other liabilities, while still allowing her to name her children as beneficiaries.

Asset Protection FAQs

1.) Is it legal to hide assets?

Yes, hiding assets can be done legally. To do so, please contact a lawyer for legal advice and do so as soon as possible.

2.) What is the legal way to hide assets from creditors?

- Retirement accounts (limited protection, early withdrawal from account = 10% of account not accessible)

- Asset protection trust

- Irrevocable trust

- A revocable trust

- Special needs trust

- Pooled-income trust

3.) When should I consider asset protection?

The ideal time to preserve your assets is well before a creditor threat is looming. This implies you should take the following precautions to safeguard your assets:

- At least two years before declaring bankruptcy.

- Before your marriage ends in divorce, (If you want to undertake particular pre-marital/pre-divorce planning and a prenuptial agreement isn't an option, it's preferable to start your program before you are married.)

- Before you are threatened with a lawsuit.

- Before your company goes bankrupt.

In general, it is too late to conduct asset protection once you have a judgment against you unless you have an agreement to pay off the judgment (and follow through on that agreement) and are just aiming to preserve assets from future creditors.

4.) How secure will my assets be in a Trust?

It depends on the Trust you set up with an attorney:

Revocable Trust- A revocable trust allows the person who created the trust to change or terminate the trust at any time during their lifetime. Most trusts are revocable. A revocable trust can help you avoid probate which is a lengthy process that your loved ones will have to go through after your death. It’s important to note that assets in a revocable trust will be considered personal assets for estate tax purposes. For creditors, this means they can potentially have access to your assets if you have debt when you pass away.

Irrevocable Trust- An irrevocable trust cannot be changed or terminated once it is created. A revocable trust becomes irrevocable when you pass away. This type of trust can protect your assets from creditors and lawsuits and reduce your estate taxes. If you ever file for bankruptcy, assets in an irrevocable trust cannot be included as they are not considered personal assets.

5.) What assets can be seized in a lawsuit?

Once a judgement has been entered against your favor, a creditor can serve an information subpoena. The information subpoena means you have to report any assets you own. Therefore, anything can be seized, ie. property, life savings, wages, cars, etc.

6.) Can I protect my assets before a lawsuit is filed against me?

Yes. Here are five things you can do to protect your assets before you get sued:

- Have adequate insurance- automobile liability insurance, homeowner’s/renter’s insurance, licensed professional insurance

- Form a trust to hold your assets

- Form a corporation or limited liability company to protect your personal assets from business creditors

- Add to retirement accounts

- Look up your state’s real estate protection laws. Some states have homestead exemptions that protect the equity in your personal residence.

7.) What is the difference between revocable and irrevocable trusts?

An Irrevocable trust can not be modified unless beneficiaries consent. By comparison, a revocable trust (living trust) can be changed at any time.

8.) Can protecting my assets make litigation easier?

If you plan ahead, yes, protecting your assets can make litigation easier. If you start asset protection planning after a lawsuit has been filed then it will be too late because it will be struck down in court as fraudulent conveyance meant to defraud a potential judgment creditor (or simply put fraud). There are multiple legal pathways one can take to protect your assets, some better for protection against lawsuits than others. If you have a high-risk job like a doctor or a contractor, consult with our attorney at the New York City law office of Inna Fershteyn to decide what asset protection plan will help you best.

9.) Do I need to create an asset protection plan?

Anyone can need an asset protection plan. Young business owners who want to protect their assets from risks; elderly who want to pass their assets down to their children or grandchildren; and those with a terminal illness who fear what will happen if they cannot pay their medical bills; all kinds of people with all kinds of assets need asset protection.

You will need asset protection, more urgently, if:

- You are about to be faced with a lawsuit

- You are in a profession where you could be heavily liable (doctor, lawyer, landlord, financial advisor, real estate developer, etc…)

- You are a debtor and/or grantor

- You have accumulated or are about to receive significant wealth (inheritance, business success)

- The value of your property has been reduced to be less than your mortgage

- You have excessive debt

10.) How much does asset protection cost?

Asset protection costs typically range from $6,000 to $10,000, depending on the complexity of your financial situation and the strategies involved. Basic plans using wills and revocable trusts fall on the lower end, while comprehensive protection using irrevocable trusts or Medicaid planning is on the higher end. High net worth individuals with multiple properties or large estates may need advanced planning starting at $15,000 or more. We offer transparent pricing with no hidden costs, and all fees are discussed clearly during your consultation.

Asset Protection Reviews

“Inna has helped us with multiple trust issues over the last five years. She has provided excellent information for our needs. She follows through and looks ahead for us. She is very smart and friendly. Her office staff is always helpful and ready to help.” - S. Butler

“Really grateful for Trust and estate advice that we received from the law office of Inna Fershteyn. Amazing service, all questions answered with care. Thank you! Will definitely recommend to all friends and family.” -Regina G.

“In the past I’ve had less than pleasant experiences with lawyers, but I can honestly say that Inna is an excellent attorney. I went to her to set up a trust and she was extremely helpful, friendly, and reassuring. Turnaround time was extremely quick, and she gave me excellent advice for the future. I would highly recommend her services to anyone looking to get their estate planning done.” - Christine P.

“There is no one I would trust more than Inna to handle my family’s estate planning. She explained everything to us and answered all questions in the appointment that we had with details. She clearly knows what she is talking about, which made us feel that much more comfortable hiring her. The paperwork was all done very efficiently, not to mention her services were very fairly priced. If I ever need legal advice or any services for me or my family, I definitely will be coming to Inna again!” - Jen K.

“5 stars is not enough for this law office. Inna helped me with an extremely complicated problem when no one else could. We needed emergency estate planning and asset protection done to protect us from creditors. Inna was able to prepare an irrevocable trust and transferred our properties into the trust within 2 weeks time. I can not recommend her highly enough for any estate planning and asset protection law.” - Klavdiya Polovetskaya

Asset Protection Videos:

Recent Asset Protection Articles

- The Best Time to Update Your Estate Plan

- How to Keep Your Money Within

- Can an IRA Affect Your Medicaid Eligibility?

- How Does A Medicaid Asset Protection Trust Work?

- Can I Give My Assets Away To Qualify For Medicaid?

Shield your wealth from lawsuits, creditors, and financial risks with a rock-solid asset protection plan. Get expert legal guidance from NYC’s top asset protection attorney. Call (718) 333-2395 to set up a consultation today!